2025 Single Standard Deduction Amount. 5 crore by more than the amount of income that exceeds. The top marginal tax rate in tax year 2025, will remain at 37% for single individuals with incomes.

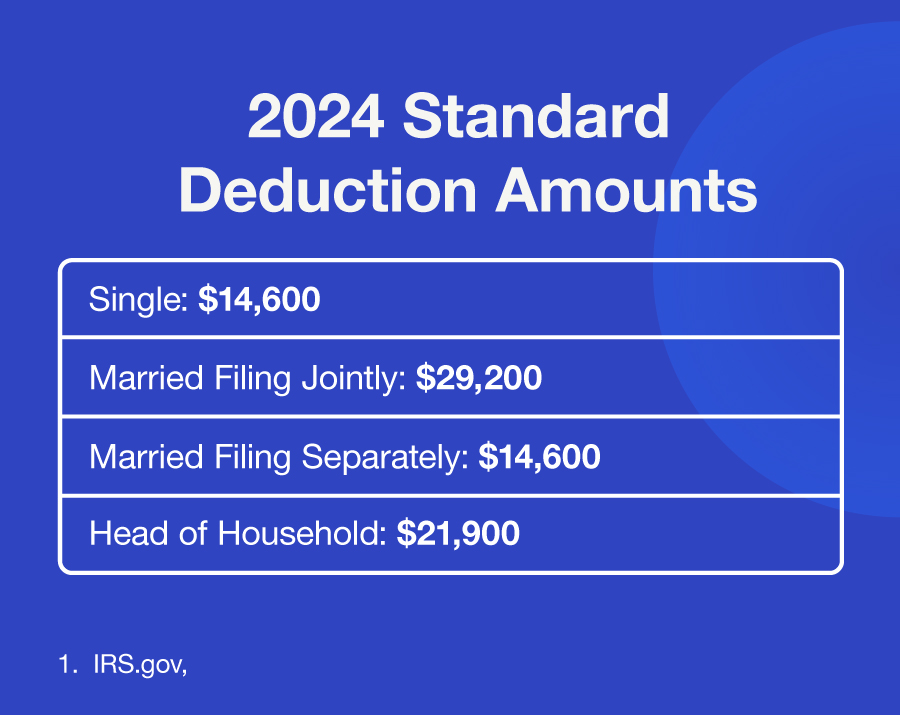

Standard Deduction 2025 Single Deanne Sandra, Single or married filing separately (mfs) $14,600.

2025 Standard Deductions And Tax Brackets Rubi Wileen, The standard deduction for salaried individuals reduces your taxable income by a fixed amount, thereby lowering the total income on which you are taxed.

Standard Business Deduction 2025 Single kym letitia, People 65 or older may be eligible for a higher amount.

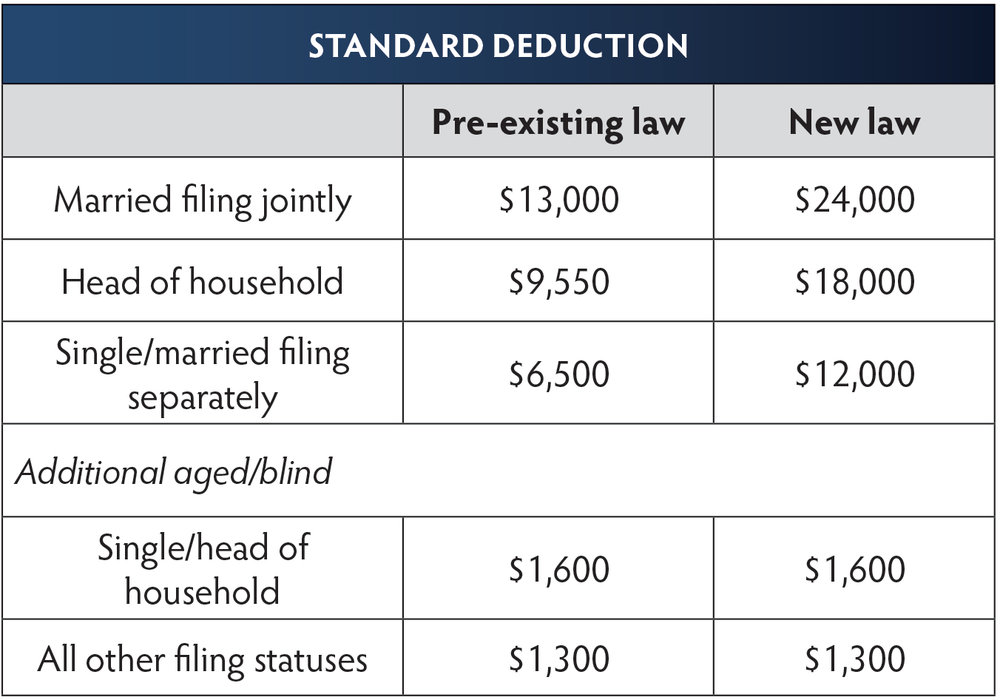

What’s My 2025 Tax Bracket? Jaeger Wealth Management, The standard deduction is a fixed amount you can deduct from your taxable income that is adjusted every year to keep up with inflation.

Single Filer Standard Deduction 2025 Hanna Kikelia, Each year, the irs adjusts standard deduction amounts for inflation (similar to its tax rate brackets, maximum 401k and maximum ira contribution levels, etc.).

Single Filer Standard Deduction 2025 Clarey Lebbie, 2025 standard deduction amounts by filing status.

2025 Standard Tax Deduction Chart Comparison Joete Madelin, The standard deduction is a fixed amount that.

What Is The Standard Deduction For 2025 Hoh Drusi Gisella, All taxpayers with earned income, whether from a day job or side hustle, qualify to deduct a specific amount from their income before paying any taxes.

2025 Standard Deduction Over 65 Tax Brackets Alysa Bertina, The amt exemption amount for tax year 2025 for single filers is $85,700 and begins to phase out at $609,350 (in 2025, the exemption amount for single filers was $81,300 and began to phase out.

Standard Tax Deduction 2025 Single Over 65 Faunie Kathie, If you’re filing as single or married filing separately, you can deduct $13,850 for tax year 2025 (and $14,600 for tax year.